In yet another sign of improvement in our economy, ASCE is predicting strong growth in the Architecture, Engineering and Construction (AEC) industry starting in 2022.

A recent article in Civil Engineering Magazine entitled “2022: The first of several solid years for the AEC industry” cited numerous factors for a robust outlook. 2020 was hit hard with COVID-19 and the experience in 2021 was continued slowdowns as the result of labor shortages, supply chain disruptions and rapidly increasing prices in construction materials. Despite these issues, the 2021 3rd quarter showed healthy growth in most indices, boosting the AEC industry.

A positive outlook for the AEC industry in 2022 and beyond comes from and with these factors:

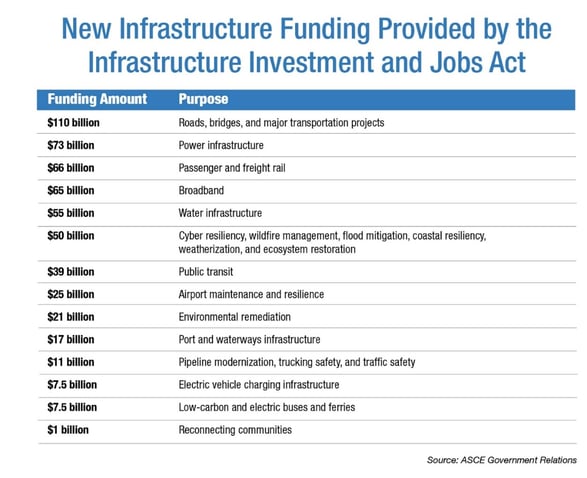

- The Infrastructure Investment and Jobs Act (IIJA) was signed into law in mid-November 2021, committing nearly $550 billion to multiple infrastructure categories over five years as shown in the chart below.

A/E firms will see the initial effects of this public infusion of capital later in the year. Construction spending will be most significant starting in early 2023 and continuing through 2026.

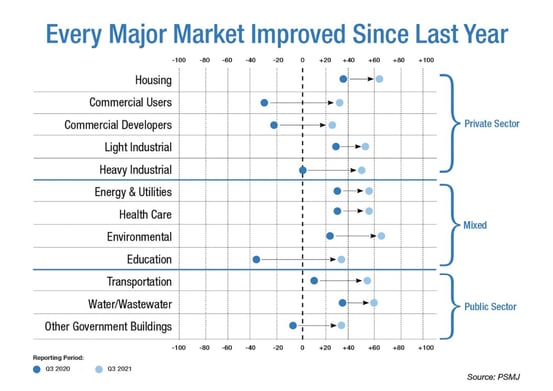

- When comparing year-over-year growth among infrastructure categories, PSMJ Resources (PSMJ) indicates substantial improvement in numerous markets during 2021, as shown in the graph below. Note the negative growth as indicated by 2020 growth (or decline) over the prior year, 2019.

- PSMJ noted that even before the passage of the IIJA, proposal activity by Civil Engineering firms remained strong in the 3rd quarter of 2021. While the activity decreased from 2nd to 3rd quarter, it still represented one of the highest in the last 18 years.

- Public sector water/wastewater was one area that showed continued growth, modestly, even over 2019. Public funding as well as a recent increase in mergers and acquisitions will propel this segment in the next few years. Also helping helping private sector growth is the increasing emphasis on water as a driver to sustainability by corporations.

- Dodge Data & Analytics predicts a 6% gain starting in 2022 in the nonbuilding construction category including highways/bridges, environmental and power plants. Categories feed each other: Highways/bridges create needs for water-related infrastructure as do power plants, etc.

- Moody Analytics sees a broader economy that is improving nationwide with the AEC industry expecting to ride the coattails.

- Unknowns include COVID-19, material pricing, interest rates, material supply and labor supply. The discussion seems to be growing about labor supply in Civil Engineering firms. PSMJ points out that there were greatly reduced numbers of Civil Engineers graduating in the late 1980s as well as the late 1990s to early 2000s. This leaves a gap in mid-level experienced Civil Engineers today.

An earlier blog post pointed out the areas where geomembranes were vital to addressing the key infrastructure needs as presented in ASCE’s annual report card. Interestingly, ASCE’s findings found their way into many discussions when formulation and debate on the infrastructure bill occurred. Based on the content of that legislation, public funding will address some of those issues and the private sector will increase expenditures in many areas as well.

Let’s take a look now at how geomembranes can provide solutions in several areas expected to grow in 2022 and beyond.

- Transportation. A majority of the language in the ASCE article is focused on bridges and highways. A recent innovation has been the use of lightweight Expanded Polystyrene (EPS) geofoam to replace compacted fill in many bridge applications. Puncture and hydrocarbon resistant geomembranes are essential in these applications to ensure survivability of the geofoam.

Geofoam encapsulation with XR-5 Geomembrane.

Geofoam encapsulation with XR-5 Geomembrane.

Interstate 5, California, USA

- Water. Replacing and updating aging water treatment plants will be an important part of infrastructure spending, especially with pending Federal regulations for emerging contaminants such as PFAS. Diversion baffles, or curtains, and finished water reservoir covers made of high-strength NSF61 approved geomembranes offer cost savings, increased treatment efficiency and increased operational flexibility.

XR-5 PW finished water floating cover. Pennsylvania, USA

XR-5 PW finished water floating cover. Pennsylvania, USA

- Wastewater. Sanitary sewer overflow (SSO) management is one of the top municipal wastewater system concerns. Sunlight resistant, low thermal expansion-contraction geomembranes are the barriers of choice for impoundments to manage these system overloads. Maximizing site availability is efficient and cost-effective. A recent case history demonstrating these efficiencies can be viewed here.

XR-5 lined SSO impoundment. Alabama, USA

XR-5 lined SSO impoundment. Alabama, USA

- Energy and Utilities. Geomembranes support this segment in a variety of ways. Starting with oil & gas production to distribution of power and storage of petroleum, geomembranes are relied upon to contain various liquids for protection of the environment and retention of valuable products. This includes secondary containment of hydrocarbons, high purity water containment, and storage of elevated temperature water/stormwater/runoff water. High strength, low thermal expansion-contraction geomembranes are the

products of choice.

XR-5 geomembrane lined process wastewater impoundment.

XR-5 geomembrane lined process wastewater impoundment.

Nuclear Power Plant, Tennessee USA

The void in midlevel Civil Engineers emphasizes the need for reliable consultation with industry supplier experts. In 21st century America, these people function as technical consultants as opposed to “sales” people, a concept geared toward application specialists. Consider utilizing these industry resources in your geomembrane selection and design.

References

For more information on the ASCE predictions for 2022 and beyond, see article below:

Landers, Jay, “The first of several solid years for the AEC industry”, ASCE Magazine, January/February 2022.

All photographs are sourced from Seaman Corporation. All charts are sourced directly from Civil Engineering Magazine.